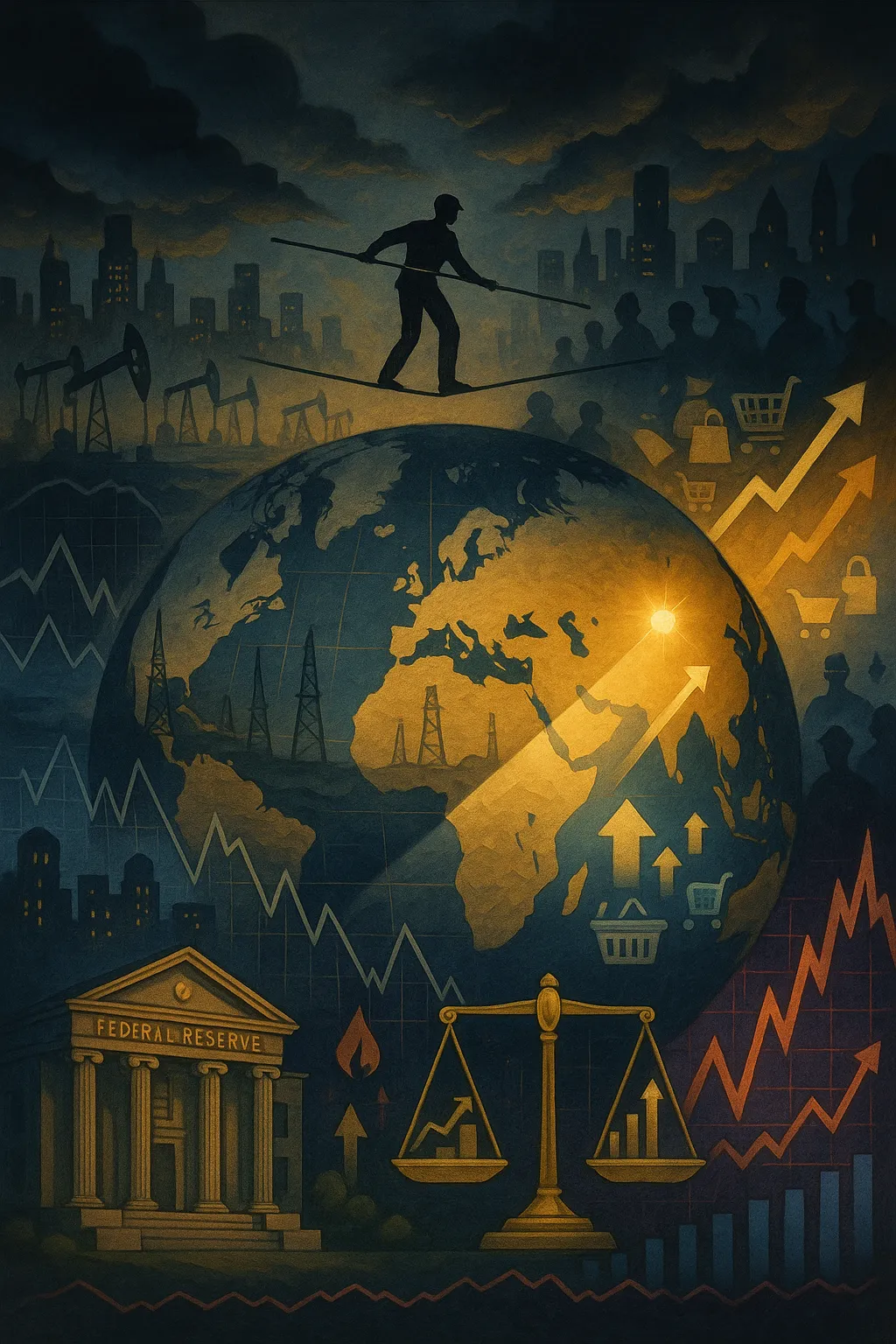

The Tightrope Walk: How Global Markets Are Navigating 2025’s Perfect Storm

Fragile ceasefires, stubborn inflation, and surprising growth stories are reshaping the economic landscape as the world grapples with its slowest growth in decades

June 24, 2025 – Economic Correspondent

The global economy feels like it’s walking a tightrope—one wrong step and everything could tumble. Today’s headlines paint a picture of a world economy caught between geopolitical fires, persistent inflation, and surprising pockets of opportunity that nobody saw coming.

When Oil Prices Sneeze, Everyone Catches Cold

This morning brought a collective sigh of relief from trading floors worldwide. Oil prices plummeted 4% after news of a fragile ceasefire between Israel and Iran, with U.S. crude settling around $66 per barrel. Stock markets from New York to Tokyo rallied on the news, but seasoned traders know better than to celebrate too early.

“It’s like defusing a bomb—you’re relieved when it works, but you know there are more wires to cut,” explains Sarah Chen, a commodities analyst at Goldman Sachs. The Strait of Hormuz, through which roughly 20% of the world’s oil passes, remains a powder keg that could reignite at any moment.

The International Monetary Fund isn’t mincing words: any escalation in U.S.-Iran tensions could drag down global growth through spiking energy costs. When oil prices jump, everything from shipping to manufacturing gets more expensive, creating a ripple effect that touches every corner of the economy.

The Slowdown Nobody Wants to Talk About

Here’s the number that should keep everyone awake at night: 2.3%. That’s the World Bank’s projection for global GDP growth in 2025—the slowest pace since the 1960s. Let that sink in. We’re talking about economic growth so sluggish it harks back to an era when the Beatles were topping the charts.

Developing economies, once the engines of global growth, are cooling off rapidly. It’s a stark reminder that the post-pandemic recovery wasn’t as robust as many hoped. The global economy is running on fumes, and traditional growth drivers are sputtering.

But here’s where it gets interesting: low-income countries are still expected to grow around 5.3%. It’s a reminder that economic stories aren’t uniform—while wealthy nations struggle with inflation and stagnation, some of the world’s poorest countries are experiencing genuine economic momentum.

America’s Economic Puzzle

The United States is presenting its own economic riddle. Business activity grew modestly in June, but the momentum is clearly fading. It’s like watching a car slowly running out of gas—still moving, but everyone can see what’s coming.

The Conference Board’s Leading Economic Index has declined 2.7% over the past six months, flashing yellow warning lights across economic dashboards. Yet economists aren’t predicting a recession. Instead, they’re forecasting something almost worse: sustained sluggish growth at just 1.6% for 2025.

“We’re not looking at a cliff, but a very long, very boring hill,” says Dr. Michael Rodriguez, chief economist at the Peterson Institute. “The kind of growth that feels like standing still.”

The Fed’s Balancing Act

Federal Reserve officials are walking their own tightrope. They’re projecting two quarter-point rate cuts in the second half of 2025, but their rationale reveals a troubling picture. Inflation is expected to hover near 3%—well above their 2% target—while unemployment is projected to rise toward 4.5%.

This combination has economists dusting off a word they hoped to never use again: stagflation. The toxic mix of stagnant growth and persistent inflation that plagued the 1970s is starting to look like a real possibility.

“The Fed is trying to thread a needle in a hurricane,” explains Maria Gonzalez, a monetary policy expert at the Brookings Institution. “Cut rates too aggressively and you risk reigniting inflation. Stay too tight and you guarantee a recession.”

The Unexpected Bright Spot

Amid all this economic gloom, one story stands out like a beacon: India is about to experience a $40 billion consumer spending surge. Salary growth, tax relief, and easier credit are combining to create a consumption boom that has investors worldwide taking notice.

This isn’t just good news for India—it’s a reminder that economic opportunities still exist for those willing to look beyond traditional markets. While developed economies struggle with debt and demographic challenges, emerging markets like India are experiencing the kind of organic growth that creates real wealth.

“India represents what healthy economic growth looks like,” says investment strategist David Kim. “Rising wages, increasing consumer confidence, and expanding credit access. It’s Economics 101, but it works.”

The Price of Everything

Tariffs continue to cast a shadow over the U.S. economy, with price pressures firming across multiple sectors. What started as a trade policy tool has become a persistent source of inflation, making everything from electronics to clothing more expensive for American consumers.

The cruel irony is that policies designed to strengthen American competitiveness are making American consumers poorer. It’s a textbook example of how good intentions in trade policy can produce unintended consequences.

What This Means for Everyone

The economic landscape of 2025 is defined by fragility. Geopolitical tensions can send oil prices soaring overnight. Central banks are running out of traditional tools to boost growth. Even moderate economic success feels like a victory.

For businesses, this means planning for multiple scenarios and building resilience rather than chasing growth. For investors, it means looking beyond traditional markets to find genuine opportunities. For policymakers, it means accepting that the easy solutions have been exhausted.

The tightrope walk continues, and nobody knows exactly where it leads. But one thing is certain: the economic playbook of the past decade no longer applies. Success in 2025 belongs to those who can adapt to a world where slow growth is the new normal, and every bit of stability is hard-earned.

The question isn’t whether we’ll reach the other side of this economic tightrope—it’s what we’ll find when we get there.